The 10 Best Car Insurance For College Students

Higher-level education isn’t cheap. And getting auto coverage for university learners is almost as expensive as campus life. Several factors can frustrate your efforts to secure cheap car insurance for college students. First, your short driving record is a red flag that you’re likely to get into accidents. As a result, insurance carriers will hike up your policy rates. But obtaining a low-cost policy for your vehicle shouldn’t be difficult, even if you still depend on your folks. You can find affordable car insurance for college students with most carriers through special campus discounts.

First, you can qualify for a good student discount, which caters to full-time learners with a minimum of 3.0 GPA grade. Keeping your car at home doesn’t mean you won’t get a special offer. There’s a student away at school price-cut for those that don’t use their vehicles on campus. Completing some driver’s training programs can also qualify you for money off your policy rates. You’ll need these deals because most states, including California, require motorists to insure any registered automobile they use on public roads.

Therefore, you don’t have to break the bank to meet this necessary expense. While car insurance for college students cost more than other driver profiles, there’s a way to reduce your premiums. In this article, we’ll explore the details about insuring your automobile in college. Besides, you’ll learn how to secure excellent deals and tips for choosing the best auto insurer for your needs. And if you’re not a campus driver but want to save on auto insurance, check out our guide on best insurance on leased cars.

Cheap Car Insurance for College Students: Everything You Should Know

While some companies provide very cheap no money down car insurance, a campus student is unlikely to qualify for these deals. Auto coverage can seem expensive, especially when you are young and broke. And your dollars can’t do much if you are a campus student. Once you pay for rent, fees, tuition, and books, you’ll be lucky to spare something for occasional weekend treats. So, the last thing you need is to make an overpriced student car insurance payment.

Regardless, you should know who pays more between college students and other driver categories. The following chart compares average car insurance rates for college students vs other driver profiles. It should give you an idea of the finest cheap car insurance for college students you might encounter.

From the chart, it may look like undergraduate learners should prepare to pay a premium. Fortunately, some carriers now provide special prices on car insurance for college students.

While auto policies often charge high premiums for young drivers, there are few ways to save your bucks. Therefore, if you have a car, it’s vital to carry the minimum liability coverage if you can’t afford more. If you hit another motorist, your liability policy will pay for their repairs. If another driver hits you, their liability coverage will pay for your repairs.

But you’re out of luck when you cause an accident that does not involve another vehicle. In such a case, you’ll pay for repairs from your pocket, unless you have collision coverage. That’s why we recommend that you start with cheap car insurance for college students. Lucky for you, we’ll be highlighting ten excellent car insurance for college students provider companies in 2020. Also, check out these cheapest cars to lease if you don’t own a vehicle currently and are planning to get one.

If you are set to have an automobile on campus, let’s discuss how to obtain the best insurance deal.

Who Needs Car Insurance for College Students?

All learners who want a vehicle at the university should get car insurance for college students. Forty-eight states in America require all drivers to insure any car they’ll drive on public roads. The state of Virginia allows you to drive without insurance provided you pay a $500 fee for uninsured motorists. You’ll neither pay a fee nor carry any insurance in New Hampshire.

What happens when you go to school in one of the two states, and you hit a stranger’s car? You’ll be paying for all damages and medical bills out-of-pocket. So, the bottom line is you need a students’ car insurance if you own a vehicle. And you definitely want car insurance for college students where the law doesn’t require you to have it.

Using Family Insurance When Taking Your Vehicle To College?

The majority of insurance carriers will let you stick to your parents’ plan even if you bring the car to college. But this is only applicable in one of the following situations;

- When your vehicle’s title is in the name of your parents

- If you stay with your parents while attending school

- If you stay in college while using your parents’ permanent address

While it’s possible to be a family insurance plan and use the car in college, is it a good idea to stick to their policy? Car insurance for college students often costs less when sharing their parents’ policy. Though there are exceptions to this option. You’re likely to save more by getting separate insurance if one of these conditions apply;

- You school in a rural town while your parents stay in a large city: You already know that auto insurance rates can vary according to zip codes. In this case, those who live in small towns often get cheaper premiums than city residents.

- You don’t have a clean driving history: If you caused an at-fault accident when using your parents’ plan, you probably raised everyone’s rates. Consider shopping for a separate policy, particularly one that offers accident forgiveness. Doing this can save you and family members substantial money.

- A family member has a spotty driving history: One driver can hike the premiums for everyone in a shared plan. It’s best to isolate yourself on a different policy, especially where the family has compounded car incidents on record.

These cases confirm that car lending is a bad idea. Your insurance policy follows the vehicle and not the person behind the while. If a college-mate causes an accident with your car, you’ll end up with raised premiums and deductibles.

What The Minimum Auto Coverage For College Students?

Before shopping for auto coverage, it is vital to understand the types of insurance you need. You should especially know the minimum car insurance requirements in your state. For instance, all the states require you to have at least property damage and bodily injury auto coverages. The minimum standards ensure that the at-fault party pays for the other driver’s car repairs plus medical bills.

Regardless, there are up to six types of car insurance policies, depending on your state:

- Bodily Injury Liability: BI will pay for the victim’s medical bills in an accident where you’re at fault. In some instances, it may cover legal expenses from a lawsuit.

- Property Damage Coverage: If you cause an accident, PD will cater to the other person’s vehicle and property damages.

- Personal Injury Protection: A select states require drivers to carry PIP liability to pay for your injuries and those of your passengers, irrespective of has caused the accident. In other cases, PIP insurance includes funeral costs.

- Uninsured and Underinsured Protection: Similarly, some states require motorists to buy this insurance policy. It covers your costs if an underinsured or uninsured driver causes an accident in your car. The extensive coverage often pays for all kinds of bills such as lost wages, medical bills, as well as auto repairs.

- Collision Policy: Your auto lender may direct you to purchase collision and comprehensive coverage, especially when still making payments. The collision policy covers the cost of vehicle repairs if you get into an accident.

- Comprehensive Liability: Other than collision coverage or OTC pays for repairs or car replacement for an event that doesn’t involve a collision.

Factors To Consider In The Best Cheap Car Insurance For College Students

You can save as much as 50% with our below list of the best cheap car insurance for college students. However, you can still get more affordable rates with proper research and quotes comparisons. So, you’ll want to keep an eye out for the following college-friendly insurance discounts and packages;

- Volunteer Discount: You can get this offer from a majority of top insurance companies if you volunteer over forty hours annually.

- Distant Student Discount: Some of the providers have price-cuts for learners who travel more than 100 miles from home to go to college.

- Low-Mileage Discounts: Several carriers have low-mileage offers. But you can save the most cash if you get pay-per-mile discounts, especially if you drive less than 3k miles annually.

- Student Organization Discount: Other auto-policy providers offer a special price for learners with membership in national student associations, sororities, and fraternities.

- Good Student Discount: Most insurance carriers provide a student discount for maintaining a particular GPA.

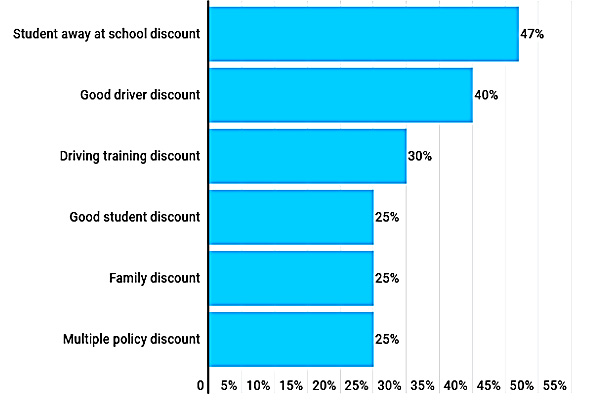

Here is a summary of the average discount rates for which you might qualify:

10 Best Cheap Car Insurance For College Students

We understand that you’re eager to know the most affordable cheap car insurance for college students. But before that, these companies had the lowest general quotes for young drivers in college;

| Auto Coverage Provider | Most Affordable College Student Rate |

|---|---|

| Dairyland Auto Insurance | $36 a month |

| Mercury Auto Insurance | $54 a month |

| MetLife Auto Insurance | $55 a month |

| National General Auto Insurance | $32 a month |

| Workmens Auto Insurance | $49 a month |

The following are the cheapest car insurance for college students provider companies in 2020.

1. The American Automobile Association – AAA

AAA has been offering auto insurance policies since 1902. The company operates both in the US and Canada, with over fifty-eight million customers. Apart from providing vehicle coverage, you’ll receive round-the-clock roadside help plus substantial discounts for campus students.

Undergraduates’ price-cuts include;

- 14% good student money off

- 5% discount for driver training

- 46% price reduction for student away at school offer

Keep in mind that you must take a driver’s education and training course that AAA approves to qualify for their driver training discount.

2. GEICO Auto Insurance

Have you seen GEICO commercials? Well, they offer more than the talking lizard on Television. You can opt for car insurance for college students Geico provides to get amazing discounts. The company offers the most affordable rates of the top five largest auto insurance carriers, including;

- State Farm

- GEICO

- Allstate

- Progressive

- Farmers

You’ll get the following price-cut under the GEICO college drivers’ package;

- 15% good student money off

3. Progressive Auto Insurance

While Progressive doesn’t offer services in all the states, the provider was controlling 8.8% of the market share in 2015. The carrier provides several ways to reduce your student premiums.

Progressive car insurance for college students comes with the following discounts;

- 10% good student money off

- 10% price reduction for student away at school offer

4. Allstate Auto Insurance

According to the Insurance Information Institute, Allstate is the third-largest car insurance carrier in America, controlling ten percent of the market share. The company offers noteworthy discounts for college students, probably because of its large consumer base.

Allstate car insurance for college students comes with these plans;

- 35% good student money off

- 5% price reduction for student away at school offer

5. State Farm Auto Insurance

The Insurance Information Institute’s survey of 2015 gave State Farm an 18.3% market share. The metric saw State Farm rise to the top vehicle coverage provider. The company’s size and geographic cover in all fifty states enable it to offer sizeable discounts for college learners.

The best student discounts include;

- 25% good student money off

- 15% price reduction under its TeenSmart training program

6. American Family Insurance

The American Family is among the largest insurance companies in the US. And while they only have two discounts for student drivers, the price-cuts can reduce a significant percentage from your rates.

Undergraduates’ discounts include;

- 25% good student money off

- 10% TeenSmart price reduction

7. Auto-Owners Insurance

The company boasts 6k+ agencies across the US with 100+ years in business. All the years in the industry must have taught them to provide the most affordable car insurance for college students.

While this firm only serve twenty-six states, you’ll get the following price-cuts at Auto-Owners;

- 20% good student money off

- 25% price reduction for student away at school offer

8. MetLife Auto Insurance

MetLife is one of the oldest auto coverage carriers in the US. The company has been in business for over 150 years, with more than ninety million members in 60+ countries. MetLife’s deep history plus broad reach contributes to its variety of student discounts.

Price reductions for higher-level learners include;

- 15% good student money off

- 7% discount for TeenSmart driver training

- 10% price reduction for student away at school offer

9. Safeco Auto Insurance

Even though you’ll find different types of coverage with Safeco, they have limited technological features. Unlike most of their competition, for instance, they only allow you to file claims online in specific states.

You can take advantage of these students price-cuts from Safeco;

- 16% good student money off

- 15% discount for TeenSmart driver training

- 20% price reduction for student away at school offer

10. Westfield Auto Insurance

Don’t be quick to write off Westfield as a small player in the insurance field. The company gives some sizeable discounts for students. The price-cuts make Westfield Insurance a competitive alternative and a potentially excellent place to get cheap car insurance for college students.

You can sign up for one or more these students markdowns;

- 25% good student money off

- 15% discount for TeenSmart driver training

That’s all from us concerning low-cost car insurance for college students. Although these certainly don’t represent the most exceptional auto coverage offers in the market. You could obtain cheaper premiums from these and other providers, depending on personal qualifications. Keep in mind that most insurers will look at your driving record among many other factors to calculate your quote. So, before moving to the FAQs and wrapping up the post, let’s first talk about how to save cash on auto insurance.

5 Money Saving Tips On Car Insurance For College Students

We believe you know the standard factors that carriers use to calculate coverage prices for young motorists. Some of the common ones include the make and model of your automobile, your driving history, and your location. But other factors can influence your auto insurance rates, as well.

Watch out for these five elements to save good money on car insurance for college students;

1. Discounts for Safe Driving

Nearly all insurers will reward policyholders for consistency in avoiding speeding tickets, accidents, plus filing claims. Besides, some providers have unique programs that track down your driving habits. For example, Snapshot by Progressive is a discount program that monitors a driver’s driving pattern and awards price-cuts for consistently driving safely.

2. Uncommon Driver Discounts

Every college student wants to maintain good grades to qualify for an auto-insurance price-cut. But did you know you could get a sizeable discount to leave your vehicle home when attending college? Most carriers give a ‘student away from home’ offer. The plan lets you utilize the car when you’re back during holidays or weekends.

3. Standalone vs Shared Insurance Plan

You can often secure better coverage deals when your parents include you in their existing car policy. However, keep in mind that policy terms can differ across providers. You’ll obtain superior rates by sticking to the family plan for the first couple of years. And you can qualify for cheaper premiums on a separate package once you turn nineteen or twenty.

4. Discounts for Driver Training

Take a certified driver’s training course to qualify for low-cost car insurance for college students with most carriers. But make sure your auto coverage provider approves of the training before you start.

5. Grades

Insurance providers are doing a commendable job at helping students improve their grades. These companies motivate learners by offering special rates for achieving good scores. So, slack off in class and forget about good student discounts.

The Bottom Line

You’ve seen the tons of options for college drivers to secure excellent policy premiums. Regardless, all providers of car insurance for college students are not the same. Some carriers give better student discounts than others do. So, we recommend that you get several company quotes to determine who has the finest offer. You’ll have to compare different premiums, discounts, as well as coverage levels. For example, AAA has the best student away at school discounts. It’s an excellent option for those who want a reward for parking their cars at home while in college. But if you prefer to use your vehicle on campus and can maintain good grades, Allstate has a matching deal.